Foreword

What will the Luxury Consumer be Wearing Next Season, One Year Into the Pandemic?

The world is facing the most serious and complex set of challenges in a century. At a moment like this discussing fashion trends might seem frivolous. But fashion trends can offer illuminating insight: how customers feel about the present and the near future is revealed by their wardrobe choices.

We at Moda Operandi are uniquely positioned to preview upcoming fashion trends. This is because we are the only platform on which customers can pre-order next season’s collections through our proprietary Trunkshow model. By analyzing thousands of these pre-order transactions each season, we get an early read on what will be trending months from now—be it designers, silhouettes, styles, colors, etc. And it is our hope that the entire fashion industry can benefit from these insights. That is the premise on which our bi-annual Runway Report was born.

For this next edition, however, our objective goes beyond just predicting upcoming fashion trends. Rather, we’re asking how that trend data can help us understand the mindset of our consumers in the pandemic era. What do their fashion investments reveal about how they are thinking about their future lifestyles?

In our last Runway Report in April 2020, we examined how drastic lifestyle changes brought on by the pandemic affected how the luxury consumer was shopping. Three months into the global crisis, our data showed a consumer shift toward a more conservative “quiet luxury,” a trend characterized by higher value, timeless pieces like fine jewelry, luxury home products, and hand-crafted fashion, and perhaps signaling a newly de-stabilized confidence in the market. Steep increases for search terms like “sweatpants” showed us the consumer was spending a disproportionate amount of time indoors, while upticks in sales for highly emotional pieces (such as Mach and Mach’s Crystal Satin Pumps, priced at $995) suggested they maintained bouts of optimism for the future.

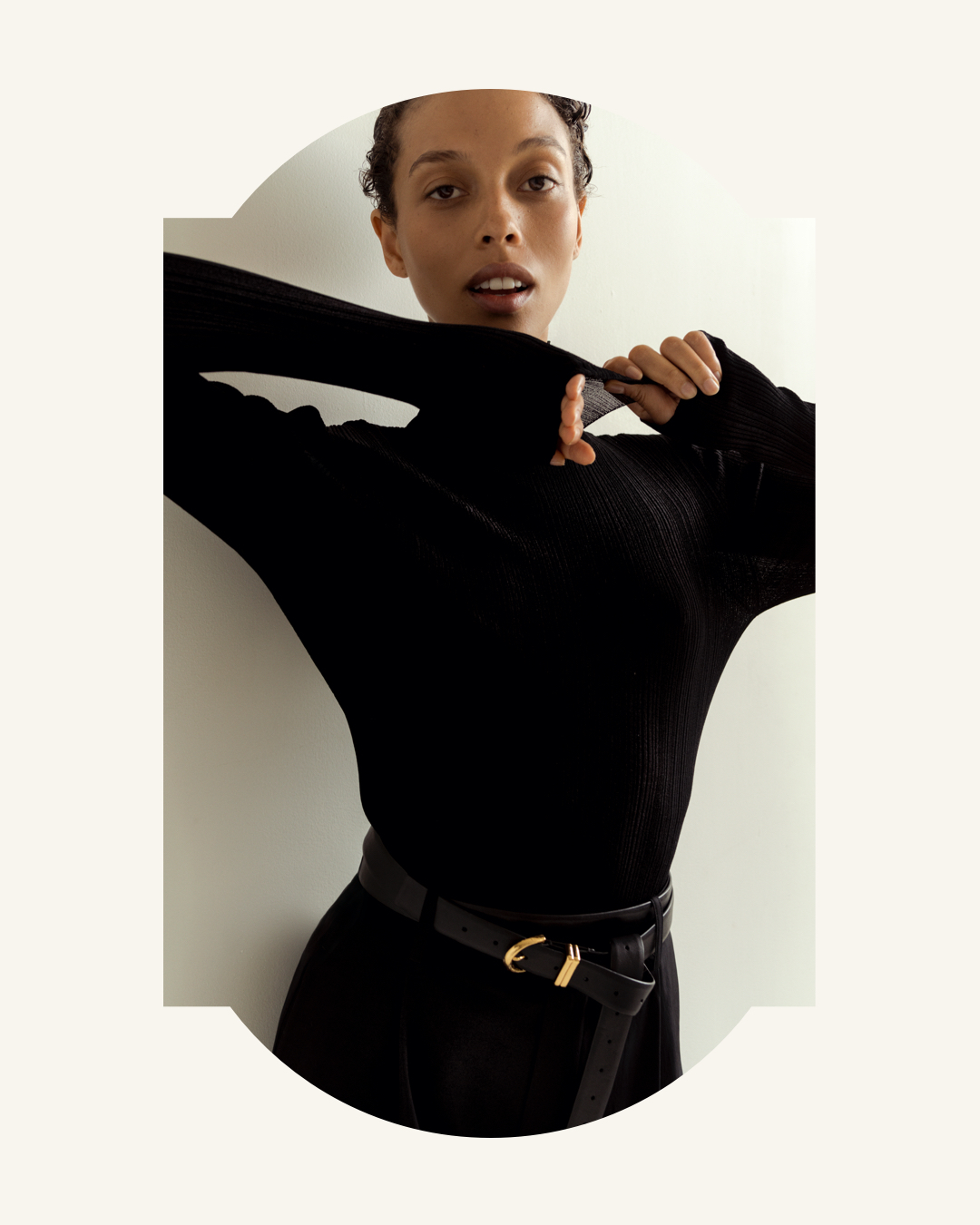

Fast forward to today. How is the luxury fashion consumer thinking about her life six months from now, and how is she planning her wardrobe accordingly? Despite conjecture in the public domain that sweatpants will dominate for seasons to come, due to ongoing lockdowns and restrictions, our data indicates a far more “optimistic” outlook. Yes, comfort will be a resounding theme in the season ahead, but that comfort will not come at the expense of style. The luxury consumer is seeking a wardrobe that evokes an easy, relaxed sense of high fashion, perhaps anticipating a lifestyle where socialization happens among small groups at home. This trend toward easygoing wardrobing is complemented, however, by the luxury consumer’s continued desire to acquire higher-value designer pieces. We saw this manifested through an uptick in spend for long-lasting “forever” pieces, as well as extravagant, trend-driven splurges.

Despite many conjectures in the public domain that sweatpants will dominate for seasons to come, our data suggests a more optimistic outlook.